Autumn Statement 2022 – Changes to R&D Tax Relief

On 17th November the UK Government released its Autumn Statement 2022. At at a time of significant economic challenge for the UK, the government stated its priorities are stability, growth, public services and reducing national debt. These priorities have led to changes in R&D tax relief that will have an impact on businesses undertaking research and development. We outline the key changes below.

Autumn Statement 2022: What’s been announced?

In the statement, the chancellor announced that R&D relief will be ‘reformed to ensure public money is spent effectively and best supports innovation’. This will be achieved by rebalancing the rates of the reliefs. Highlighted below are the two main changes to the R&D tax relief schemes:

RDEC scheme rates increased

The chancellor reiterated the government’s commitment that R&D spending will increase to £20 billion a year by 2024-25. As part of this commitment, it was announced that the Research and Development Expenditure Credit (RDEC) rate will increase.

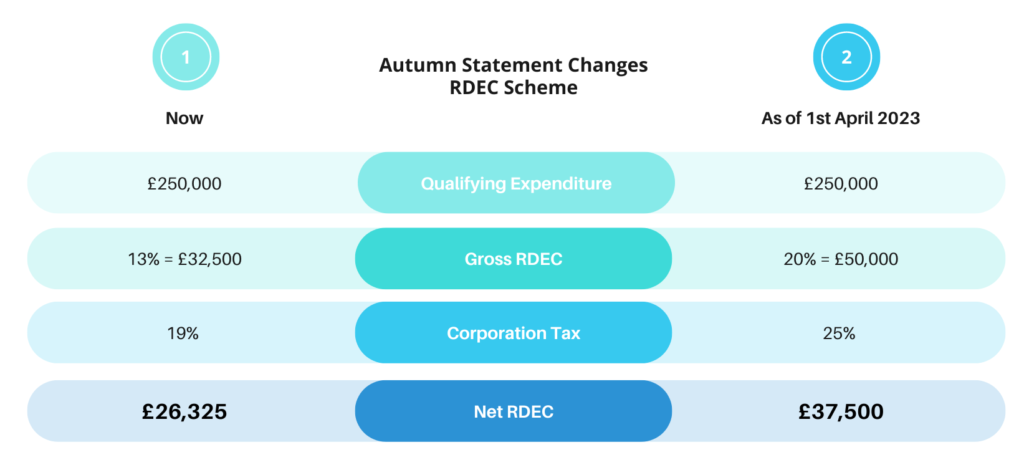

For expenditure on or after 1 April 2023, the RDEC rate will increase from 13% to 20%.

Some of the proposed changes will affect businesses in a positive way, however for others it could significantly reduce the amount of R&D tax credit a company receives. The main changes are highlighted below

What does this mean for companies claiming under the RDEC scheme?

The RDEC rate increase from 13% to 20% equates to a circa 42% uplift in benefit received. The increase will improve the competitiveness of the scheme and hopefully result in a significant increase in investment in R&D, underpinning the government’s growth strategy. The change also moves a step towards a simplified, single RDEC-like scheme for all.

SME scheme to become less generous

In contrast, as part of a drive to improve compliance and reduce fraud and error within SME claims, the chancellor significantly reduced the generosity for SME’s.

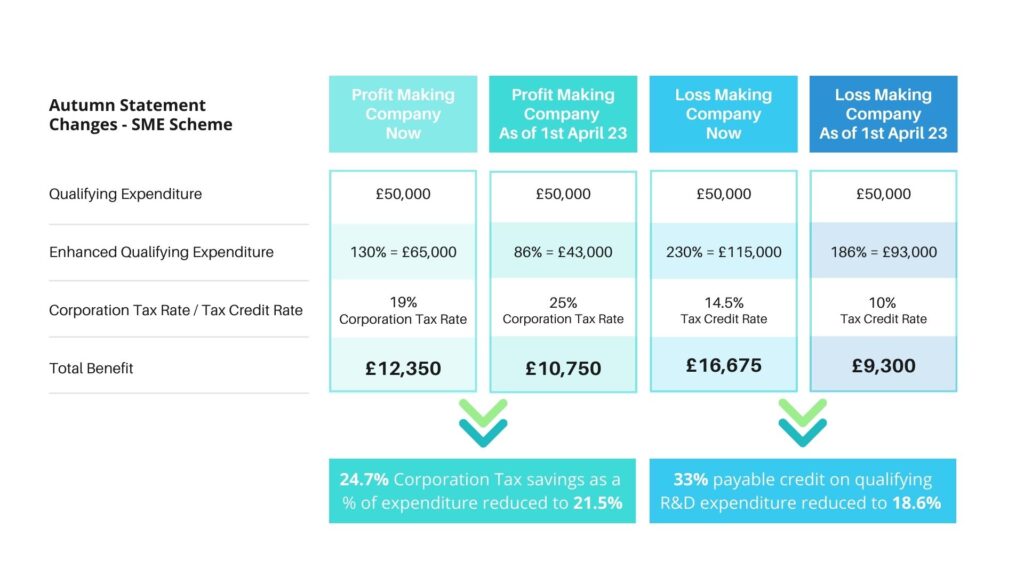

For expenditure on or after 1 April 2023, the R&D SME scheme enhanced deduction rate will be cut from 130% to 86%, and the payable tax credit rate cut from 14.5% to 10%. The example below highlights the difference this will make to the benefit for both profit-making and loss-making companies with a qualifying expenditure of £50,000.

- For a typical profit-making SME, the corporation tax savings as a percentage of expenditure is currently 24.7%. For expenditure incurred from 1st April 2023, this will be reduced to 21.5%.

- A typical loss-making SME currently receives up to 33% payable tax credit on qualifying R&D expenditure. From 1st April 2023, this will be reduced to 19%.

What does this mean for companies claiming under the SME scheme?

For innovative SME companies, the scheme becomes less attractive and may result in a reduction in their R&D investment. The greatest cost reduction will fall on start-up’s and loss-making companies that are most in need of the funding.

What does this mean if you are currently claiming?

Whether you are claiming under the RDEC or SME scheme, the changes are scheduled to take effect from 1st April 2023 – so there is time to plan. Additionally, all claims are different so the changes will impact businesses in different ways. Our technical specialists are up to date with the recent changes and will be able provide you with specific advice relating to your claim or answer any questions you may have.

What do the changes mean for Accountants?

Whether your clients are claiming under the RDEC or SME scheme, the changes are scheduled to take effect for expenditure on or after 1 April 2023. This means there will be time to plan effectively. Additionally, all claims are different so the changes will impact your clients in different ways. Moving forward, it is more important than ever to assess in-depth any clients who are making an R&D claim. Due to the increase in the corporation tax rate from 19% to 25%, carrying losses forward may be a more valuable approach, depending on individual client circumstances.

What do the changes mean for innovative companies?

The government remains committed to supporting R&D, and the amount of support provided to innovative businesses through R&D tax reliefs is expected to increase with the changes. The government has said the changes will ‘support fiscal sustainability by raising revenue and reducing fraud and error, without materially changing the levels of R&D expenditure over the forecast period’.

Comments from our Senior Technical Consultant, Matthew Thomson

“Whilst it is positive to hear the government reiterate its commitment to UK R&D spending and the associated increase in generosity for the RDEC scheme, it is disappointing to hear the unexpected reduction in rates to the SME scheme. This will be a big blow for smaller innovative start-ups’ and loss-making companies who will be hit the hardest by the changes. We hope that with the proposed move towards a simplified, single scheme for all, the support for SME R&D will be reviewed to make the relief a fair incentive for all innovative companies.“